Loans... what we do best!

Use the equity in your home to make improvements to your home, purchase a new or used car, take a vacation or pay this semester’s tuition bill. Whether you want a JSSB Timeline Home Equity Line of Credit or a JSSB fixed rate home equity loan, JSSB can provide the option you want.

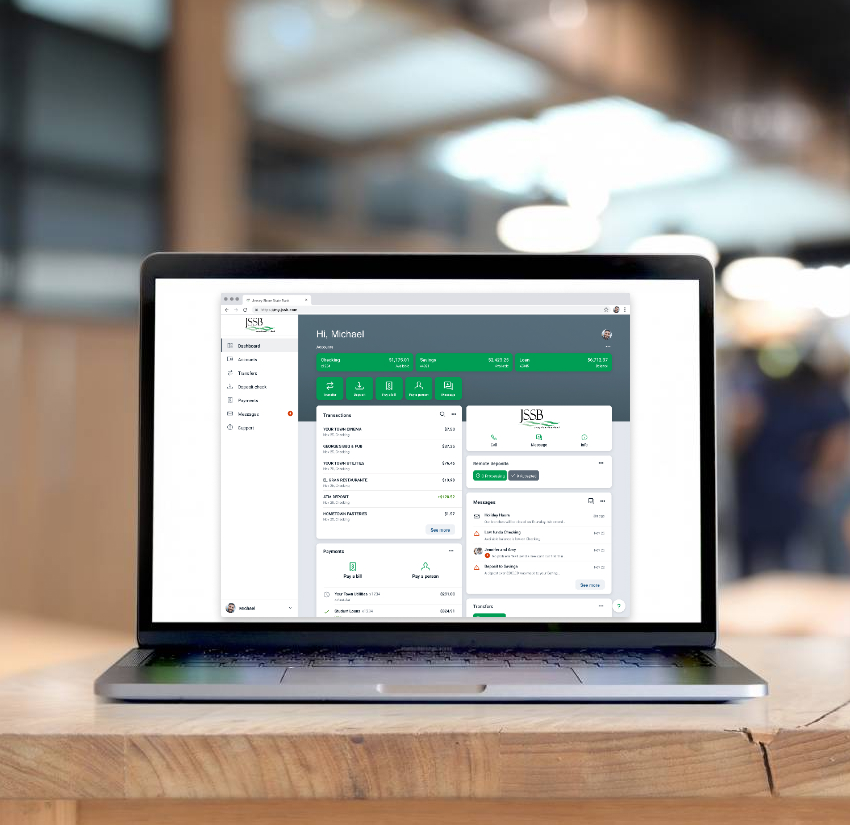

Jersey Shore State Bank is a full-service financial institution headquartered in Williamsport and serving customers in Central and Northeast Pennsylvania.

Which Option is best for you?

| Benefit | JSSB Timeline | JSSB Home Equity Loan |

|

|---|---|---|---|

| Flexible | Easy access to your line of credit and lock in up to three (3) units. |

X |

|

| Convenient | Access your line of credit by writing a check. |

X |

|

| Protection | Fixed rate option which allows for a fixed monthly payment. |

X |

X |

| Tax Deduction | Interest on your home equity may be tax deductible.* |

X |

X |

* Consult Tax Advisor.

JSSB Timeline Home Equity Line of Credit

The JSSB Timeline Home Equity Line of Credit provides a line of credit with the ability to fix the rate on a portion or unit of the loan when you want.

JSSB Fixed Rate Home Equity Loan

Use the equity in your home to receive a fixed loan amount with a fixed term. A home equity loan provides you the security of having a fixed monthly payment for a fixed time. A home equity loan is typically used for a one time big purchase such as a home improvement, vacation or new car.

Calculators

Calculators

Whatever you're borrowing for, it's good to run the numbers and figure out how the payments are going to affect your budget.